What is a commercial mortgage broker and why should you use one?

Applying for a commercial mortgage isn’t easy. The process involves finding the right lender to provide the best terms and rates for your unique transaction and then pulling together extensive financial documentation to qualify. Before you DYI, consider hiring a commercial mortgage broker.

What is a commercial mortgage broker?

A commercial mortgage broker acts as a go-between for borrowers and lenders. Mortgage brokers introduce commercial real estate owners and investors to sources of debt and equity. Mortgage brokers are skilled negotiators who generate competition among lenders for their clients to obtain a mortgage on properties such as apartment buildings, office buildings, shopping centers, and the like. A commercial mortgage broker works with direct lenders and may even offer loan programs itself as a correspondent for other capital providers.

What does a commercial mortgage broker do?

A good commercial mortgage broker has an extensive network of connections that is activated to secure the best loan terms and rates for your transaction. It is the broker’s job to connect you with several lenders and present the best offers. A mortgage broker can structure mortgage loan terms in such a way as to satisfy both you and the lender. Your loan may be complicated or straightforward. Either way, a mortgage broker can identify the best commercial mortgage lenders for your needs.

Many types of lenders provide mortgage loans, including banks, credit unions, life insurance companies, conduits, government-sponsored enterprises (Fannie Mae/Freddie Mac), private lenders, SBA, and bridge loan providers, and more. A good broker can help you navigate the landscape and get you the best, and the most appropriate, financing for your project. Commercial mortgage brokers handle dozens of transactions in a year. It is their job to understand the current lending environment, underwriting guidelines, rates, and which lenders may be in or out of the market at different times.

A commercial mortgage broker will ensure that you have a complete loan application package ready before it reaches a lender. The checklist of information that lenders look for is long. It usually includes a current rent roll, historical operating statements, photos of the property, rent comparables for similar properties in the area, net worth, liquidity, and credit scores of the key principals, a standard lease agreement, evidence of insurance, encroachments, encumbrances, environmental issues, among others. Different lenders have different requirements.

A commercial mortgage broker will see your loan to closing. There will be appraisers, lawyers, title companies, accountants, and other service providers necessary to close your loan. A mortgage broker saves you time and effort by coordinating the activities of these professionals in order to complete due diligence.

How much does a commercial mortgage broker charge?

A commercial mortgage broker’s fee generally ranges from 0%-2% of the loan amount, which is paid at closing. Is the fee worth it? If a broker can save you time and source a lower interest rate or larger loan for you, your financial return could be higher than going through your local bank. Additionally, a broker may be able to negotiate less onerous terms for you, like structuring a loan that that does not require ongoing escrow reserves or a personal guarantee.

Is it better to use a mortgage broker or a bank?

If you have an existing relationship with a bank or credit union, there may be advantages to seeking a mortgage loan on a direct basis. Many banks have preferential rates and closing costs for existing customers. Without a go-between, you will be able to communicate directly with your loan officer. There won’t be broker fees although banks do earn commissions for originating loans along with other fees.

Working with a single bank has drawbacks, however. Your bank lender may not have a wide range of loan options to fit your circumstances. If your application is turned down, you have to start all over again with another lender. In addition, bank loans are usually recourse, meaning that the borrower is 100% personally liable for the loan amount. If the borrower defaults on the loan, the bank will seize the mortgaged property and sell it. If the seized property does not sell for enough to cover the loan balance, the bank can get a deficiency judgment and go after the borrower’s other assets. A non-recourse loan, on the other hand, permits the lender to only take back the property used as collateral for the mortgage and cannot go after the borrower’s other assets. A commercial mortgage banker is more likely to have connections with lending institutions that provide non-recourse loans.

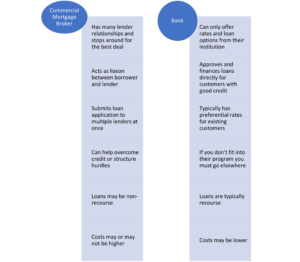

The illustration below shows some of the pros and cons of commercial mortgage brokers compared to banks:

Even if you are willing to loan shop on your own, it can be difficult to assess which lenders to approach and how to make contact with them. Lender programs can vary dramatically, making it difficult to determine which is the best match for your deal. Identifying the appropriate point of contact at a lender is often a challenge and some don’t even work directly with operators, but only through experienced brokers who understand what they are looking for.

What should I ask a commercial mortgage broker?

Before choosing a potential commercial mortgage broker, ask some questions to gauge their knowledge and experience, such as:

- How long have you been a commercial real estate broker?

- What cities and neighborhoods are you familiar with?

- Where do you see the CRE market going?

- What type of commercial real estate do you specialize in?

- What deals have you closed recently?

- What other projects/deals are you currently working on?

- Can you provide references?

- How do you get paid?

These questions are a good start when looking for the best partnership for your specific goals.

What process do commercial mortgage brokers follow?

When you first meet, a mortgage broker will conduct a fact find, which is a series of questions about you, your real estate transaction, and your financial condition. The broker can then recommend the most appropriate mortgage product to match your situation.

The broker will approach multiple lenders and present offers to you. Once you choose your preferred lender, a “term sheet” or letter of intent will be issued. This is where the lender has agreed to finance your transaction in principle based on an agreed set of terms and conditions, as long as you pass the underwriting stage following submission of a full application.

The lender’s underwriter will conduct extensive due diligence on the transaction, including reviewing your background, income history, and experience in real estate, analyzing the operating statements and tenant leases of the property, possibly conducting a site visit to the property (with your broker as escort), and finally, presenting the transaction to an investment committee for approval. At the same time, appraisals and other reports are ordered and legal documents are drawn. The process should take an average of 30-45 days; however, many lenders are swamped and it can take longer. Your broker will know which lenders can turn applications around quickly and fund your loan efficiently.

Summary

Applying for a commercial mortgage isn’t easy. The process involves finding the right lender to provide the best terms and rates for your unique transaction and then pulling together extensive financial documentation to qualify. Commercial mortgage brokers are skilled negotiators who generate competition among lenders and help close your loan. The mortgage process can be complex and confusing. A commercial mortgage broker will ensure that the job is well done.